Civil-legal liability of vehicle owners

Compulsory motor insurance

Compulsory insurance of civil-legal liability of vehicle owners is carried out in accordance with the Law of the Republic of Kazakhstan “On compulsory insurance of civil-legal liability of vehicle owners”. Operation of a vehicle if its owner does not have the compulsory vehicle owner’s liability insurance agreement is prohibited.

Online-calculator

Calculate the cost of compulsory motor vehicle insurance and complete an application in a few minutes

Insurance events

Insurance event is a fact of occurence of civil-legal liability of insured person for reimbursement of harm caused to life, health and (or) property of persons recognized as affected persons, as a result of operation by insured person of a vehicle specified in the compulsory vehicle owner’s liability insurance agreement.

Insurance premium

Amount of insurance premium in accordance with the Law of the Republic of Kazakhstan “On compulsory insurance of civil-legal liability of vehicle owners” is calculated on the basis of the basic premium set at 1.9 MCI, to which the ratios for persons established by the Law are applied depending on the following conditions:

1) place of vehicle registration;

2) type of vehicle;

3) age and driving experience of insured person;

4) period of operation of vehicle;

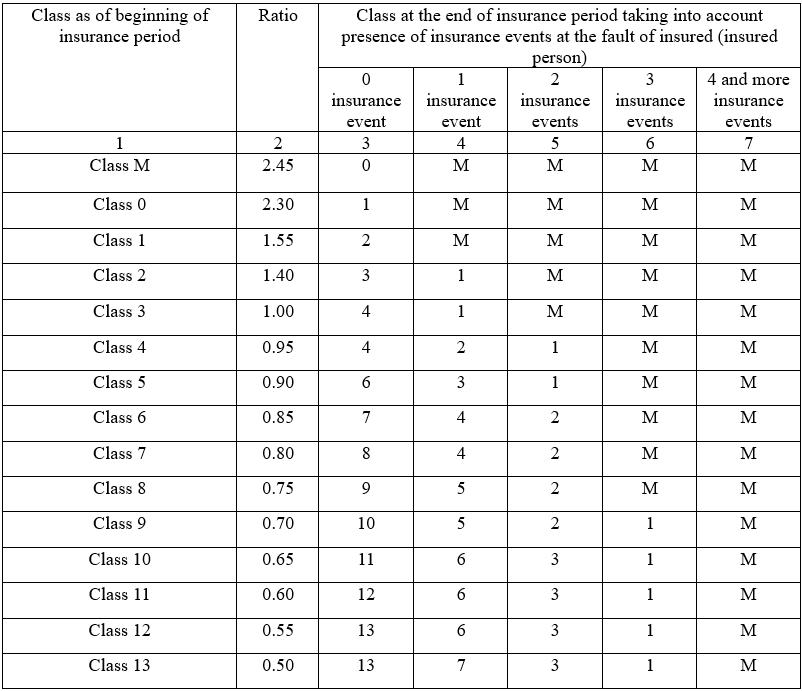

5) presence or absence of insurance events due to the fault of persons whose civil-legal liability is insured (bonus-malus system): Bonus-malus is a system of discounts and surcharges used in calculating the amount of insurance premium payable under an agreement of compulsory insurance of civil-legal liability of vehicle owners by applying to an insured (insured person) of increasing or decreasing ratios depending on presence or absence of insurance events through its fault with assignment of appropriate class under this system.

Ratios under the “bonus-malus” system with assignment of appropriate class at the end of insurance period shall be set in the following amount:

|

Class as of beginning of insurance period |

Ratio |

Class at the end of insurance period taking into account presence of insurance events at the fault of insured (insured person) |

||||

|

0 insurance event |

1 insurance event |

2 insurance events |

3 insurance events |

4 and more insurance events |

||

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

|

Class M |

2.45 |

0 |

M |

M |

M |

M |

|

Class 0 |

2.30 |

1 |

M |

M |

M |

M |

|

Class 1 |

1.55 |

2 |

M |

M |

M |

M |

|

Class 2 |

1.40 |

3 |

1 |

M |

M |

M |

|

Class 3 |

1.00 |

4 |

1 |

M |

M |

M |

|

Class 4 |

0.95 |

4 |

2 |

1 |

M |

M |

|

Class 5 |

0.90 |

6 |

3 |

1 |

M |

M |

|

Class 6 |

0.85 |

7 |

4 |

2 |

M |

M |

|

Class 7 |

0.80 |

8 |

4 |

2 |

M |

M |

|

Class 8 |

0.75 |

9 |

5 |

2 |

M |

M |

|

Class 9 |

0.70 |

10 |

5 |

2 |

1 |

M |

|

Class 10 |

0.65 |

11 |

6 |

3 |

1 |

M |

|

Class 11 |

0.60 |

12 |

6 |

3 |

1 |

M |

|

Class 12 |

0.55 |

13 |

6 |

3 |

1 |

M |

|

Class 13 |

0.50 |

13 |

7 |

3 |

1 |

M |

The contract of compulsory liability insurance of vehicle owners is concluded for a period of twelve months from the date of its entry into force.

The contract of compulsory liability insurance of vehicle owners comes into force and becomes binding on the parties from the date established by the contract of compulsory liability insurance of vehicle owners.

The contract of compulsory liability insurance of vehicle owners is considered terminated in the following cases:

1) expiration of the contract;

2) early termination of the contract;

The contract of compulsory liability insurance of vehicle owners does not terminate when the insurance payment is made.

The maximum amount of liability of the insurer for one insured event (sum insured) is (in monthly calculation indices):

- for harm caused to the life or health of each victim and resulting in:

- death — 2,000;

- determination of disability:

- first group – 1,600;

- second group – 1,200;

- third group — 500;

- child with disabilities – 1,000;

- mutilation, injury or other damage to health without establishing disability — in the amount of actual expenses for outpatient and (or) inpatient treatment, but not more than 300;

- for damage caused to the property of one victim — in the amount of damage caused, but not more than 600;

- for damage caused simultaneously to the property of two or more victims — in the amount of damage caused, but not more than 600 to each victim. In this case, the total amount of insurance payments to all victims cannot exceed 2,000.

If the amount of damage exceeds the insurer’s liability limit, insurance payment to each victim is made in proportion to the degree of damage caused to his property

To calculate your insurance premium, you can use a calculator.