Personal insurance

Rules of voluntary insurance against medical and/or medical-transportation expenses of persons traveling abroad

For what?

Under an insurance agreement the Insurer shall for a fee stipulated by an agreement and paid directly by the Insured, upon occurrence of an event stipulated by an agreement (insured event) undertake to cover through its representative (service company) the expenses for providing the Insure with medical, medical- transportation and other services stipulated by an insurance agreement up to the amount stipulated by an agreement (insured amount) and limits of liability.

If the Insured pays at its own discretion for medical and medical-transportation services the Insurer subject to and in accordance with provisions of these Conditions shall reimburse such expenses against presentation of a written application by the Insured (or other authorized person) and original documents.

The property interests of the Insured (additional expenses) associated with the need to obtain emergency medical and medical-transportation assistance upon occurrence of an insured event during its stay within the insurance territory shall be the insurance object.

TERRITORIAL LIMITS AND VALIDITY OF INSURANCE AGREEMENT

An insurance agreement shall be valid within the territory of all countries of the world except for a country of permanent residence of the Insured and a country where the Insured is a citizen.

The following shall be excluded from the territorial limits of insurance agreement:

- countries where military actions or army anti-terrorist operations are conducted;

- countries in respect of which economic and/or military UN sanctions are applied;

- territories where pest-spots are discovered and acknowledged;

- territories of countries where health of people may be likely injured.

Validity of insurance agreement shall be calculated at Astana time and shall begin not earlier than 00-00 of a date specified in an insurance policy as the beginning of insurance period and shall end not later than 24-00 of a date specified in an insurance policy as the end of insurance period.

If an insurance agreement is concluded for a period of 30 days or over the Insurer shall be liable only within the number of days (limit) to be determined in the “number of days” column of an insurance policy. In case of entry to the insurance territory the insurance period specified in the “number of days” column of an insurance policy shall be automatically reduced by the number of days spent in the insurance territory. In such a case the liability of the Insurer shall end upon expiration of the limit determined in the “number of days” column.

Minimum validity period of insurance agreement shall be 1 day, maximum – 1 year except as otherwise provided in an insurance agreement.

INSURED EVENT

Insured event shall be an event which has occurred and which is stipulated by an insurance agreement, upon the occurrence of which there is an obligation on the Insurer to make an insurance benefit.

Insured event shall be an occurred, sudden, unexpected and non-deliberate event resulting in injury to health of the Insured or death and expenses for any medical and/or medical-transportation assistance.

INSURANCE PREMIUM

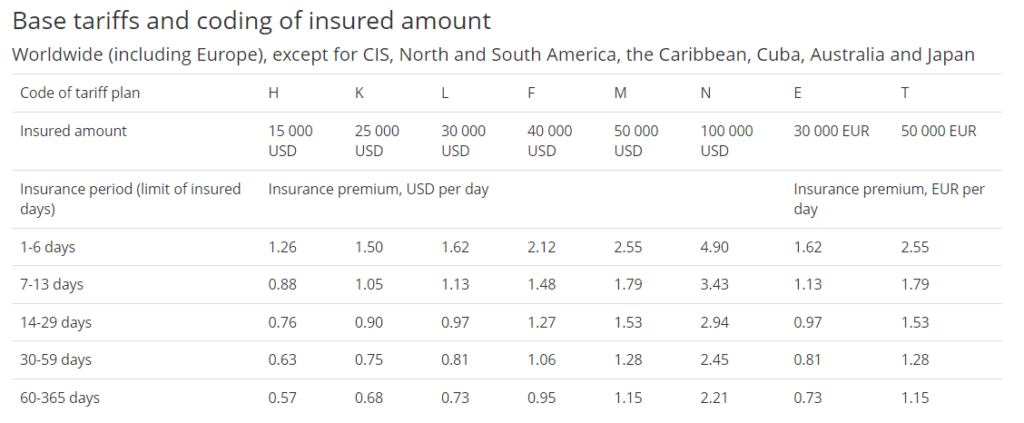

Amount of insurance premium shall be determined by agreement of the parties in accordance with the approved tariffs.

Base tariffs and coding of insured amount

Worldwide (including Europe), except for CIS, North and South America, the Caribbean, Cuba, Australia and Japan

| Code of tariff plan | H | K | L | F | M | N | E | Т |

| Insured amount | 15 000 USD | 25 000 USD | 30 000 USD | 40 000 USD | 50 000 USD | 100 000 USD | 30 000 EUR | 50 000 EUR |

| Insurance period (limit of insured days) | Insurance premium, USD per day | Insurance premium, EUR per day | ||||||

| 1-6 days | 1.26 | 1.50 | 1.62 | 2.12 | 2.55 | 4.90 | 1.62 | 2.55 |

| 7-13 days | 0.88 | 1.05 | 1.13 | 1.48 | 1.79 | 3.43 | 1.13 | 1.79 |

| 14-29 days | 0.76 | 0.90 | 0.97 | 1.27 | 1.53 | 2.94 | 0.97 | 1.53 |

| 30-59 days | 0.63 | 0.75 | 0.81 | 1.06 | 1.28 | 2.45 | 0.81 | 1.28 |

| 60-365 days | 0.57 | 0.68 | 0.73 | 0.95 | 1.15 | 2.21 | 0.73 | 1.15 |

Worldwide (including North and South America, the Caribbean, Cuba, Australia, and Japan), except for CIS

| Code of tariff plan | L | M | N | |

| Insured amount | 30 000 USD | 50 000 USD | 100 000 USD | |

Insurance period (limit of insured days) | Insurance premium, USD per day | |||

| 1-6 days | 4.05 | 6.38 | 12.25 | |

| 7-13 days | 2.84 | 4.46 | 8.58 | |

| 14-29 days | 2.43 | 3.83 | 7.35 | |

| 30-59 days | 2.03 | 3.19 | 6.13 | |

| 60-365 days | 1.82 | 2.87 | 5.51 | |

Age related multiplier

In calculation of amount of insurance premium payable under insurance agreements concluded in favor of persons older than 65 years the multiplying ratio shall be applied to the tariff:

65-70 completed years – 2;

71-75 completed years – 3;

76-80 completed years – 4;

81-85 completed years – 5.

Franchise

A 30 USD unconditional franchise is determined for Turkey and Egypt.