Financial insurance

Voluntary construction and installation

works insurance

The voluntary construction and installation works insurance involves the indemnity for:

- damage or destruction of building objects, construction and installation equipment, machinery, materials, and other property, which are the subject of construction, installation and use on site,

- as well as damage to life, health and / or property of third parties in the performance of construction and installation works, as well as the obligations of the Insured for guarantees issued to the customer on buildings, structures, equipment, and other objects that are built (assembled) by the Insured on a contractual basis in the Republic of Kazakhstan.

Insurance risks:

According to the insurance contract, the Insurer shall pay damages incurred during the construction and installation works (stages of construction works), due to damage or destruction of the insured property caused by:

- Fire

Compensable losses occurring as a result of a process of uncontrolled burning (fire) as a result of damage to the electrical system, the explosion of steam-, oil- and gas pipelines and related storage facilities, machinery, boilers and assemblies, lightning, explosion of gas used for domestic purposes. In addition, the compensable loss is caused by combustion products and fire extinguishing actions applied in order to prevent fire further spread, including when the fire occurred outside of the insurance area. - Accident (uncontrolled explosion) during blasting and other works

Compensable losses occurring during the drilling, gas, electric welding (cutting) and other works directly related to the construction of the object. - Engineering network and system fault

Compensable losses resulting from accident of water supply, sewerage and heating systems, water flooding (damage) of pits, wells, equipment, structures, mechanisms, and activation of the fire suppression system (sprinkler systems) because of its sudden and uncaused actuation. - Building accident

Compensable losses caused by the collapse of, damage to, the building or structure, in whole or individual components thereof, as well as the excess of the maximum allowable strain that threatens safe operation and entails the suspension of the construction of the facility or its part, that occurred for reasons that caused the structures or basements to reach limit state bringing to the breakage of the building, structure:- weakening of sections of structural elements, components, welds;

- additional equipment suspension for structures of different types;

- lack of protection of structures operating in aggressive environments;

- differential settlement of foundations, soil swelling;

- other causes of the building accident conditions.

- Natural disasters

Compensable losses arising as a result of these natural disasters: a storm, whirlwind, hurricane, typhoon, tornado, tsunami (damage from the storm, tornado, hurricane or other movement of air masses caused by natural processes in the atmosphere, are only reimbursable, if the rate of air mass causing a loss is greater than 60 km/h); rainfall, hail, flood, runoff (damage from flood or runoff is only reimbursed if the water level exceeds the standard level set for the area by the regional authorities, specialized units of Hydro Meteorological Service and Emergency Ministry of the Republic of Kazakhstan); earthquake, volcanic eruption, underground fire, landslide, rockfall, avalanche, landslide, mudflow, subsidence or other earth movement, flooding, groundwater, including collapse, breakdown and sliding soil (losses from the occurrence of such events are only recoverable, if they are not caused by blasting, excavation of pits or quarries, filling cavities or conducting of trimming works as well as production or development of deposits of all kinds of minerals). - Unlawful acts of third parties

Compensable damages resulting from damage or destruction (loss) of construction materials, parts and components, machinery and equipment, damage to construction objects at the site as a result of acts of third parties: theft, burglary / robbery, hooliganism.Theft

Theft occurs when a third party (attacker):

- uses lock-pick, false keys, or other technical means to seize stolen goods.

- enters the insured premises, breaking doors or windows, using lock-pick, false keys or other technical means. Keys are false, if made on behalf of or with the consent of the persons who are not entitled to dispose of the genuine key (disappearance of the property from the place of insurance is not enough to prove the use of false keys);

- cracks items used as repositories of the property, or opens them with spikes, false keys or other tools within the insured premises;

- In rooms that are used for official or business purposes, apart from the Insured and his/her employees, by third parties, the insurance cover for such loss is only available, if it is specifically provided by the contract of insurance entered into in accordance with these Rules;

- removes objects (materials, parts and components of construction machinery and equipment) from the closed premises, in which it entered in the usual way, continuously stayed there secretly until their closure, and used lock-pick, false keys, or other tools when leaving the premises.

Robbery

Robbery (hold-up) occurs, if:

- Insured or his/her employees were violated to suppress their resistance aimed at preventing removal of insured property (construction materials, parts and components of construction machinery and equipment);

- Insured or his/her employees at risk of injury or death, transfer or accept a transfer of the insured property within the place of insurance. If the place of insurance is a few of the insured building or premises, the robbery is taken as removal of the property (construction materials, parts and components of construction machinery and equipment) within the limits of the insured building or premises, in which there was a threat to health or life of the Insured or his/her employees;

- the insured property (construction materials, parts and components of construction machinery and equipment) is withdrawn from the Insured or his/her employees during the period when such persons are in a helpless state, if such state does not appear in the result of their deliberate actions, and does not allow them to resist such a withdrawal.

Disorderly conduct occurs when a third party (attacker) makes acts that result in the insured property destruction (full damaging beyond repair) or damage (violation of the integrity of the property or of individual items, machinery, tools, equipment breakdown in need of repair, etc.).

- Encounter of moving equipment

Compensable losses resulting from an encounter of moving equipment (collision) (including moving by rails) with the insured property. - Fall of manned aircraft or their fragments and items

Compensable losses suffered due to fall of the manned vehicles or their fragments and items onto the insured objects.

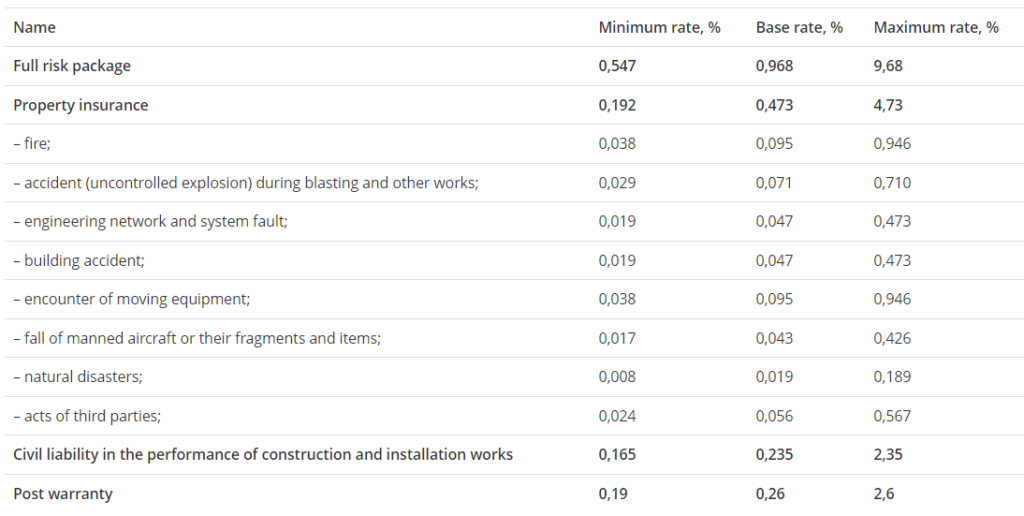

Insurance premium

The insurance premium is determined based on the size of insurance amount and tariff rates.

| Name | Minimum rate, % | Base rate, % | Maximum rate, % |

| Full risk package | 0,547 | 0,968 | 9,68 |

| Property insurance | 0,192 | 0,473 | 4,73 |

| – fire; | 0,038 | 0,095 | 0,946 |

| – accident (uncontrolled explosion) during blasting and other works; | 0,029 | 0,071 | 0,710 |

| – engineering network and system fault; | 0,019 | 0,047 | 0,473 |

| – building accident; | 0,019 | 0,047 | 0,473 |

| – encounter of moving equipment; | 0,038 | 0,095 | 0,946 |

| – fall of manned aircraft or their fragments and items; | 0,017 | 0,043 | 0,426 |

| – natural disasters; | 0,008 | 0,019 | 0,189 |

| – acts of third parties; | 0,024 | 0,056 | 0,567 |

| Civil liability in the performance of construction and installation works | 0,165 | 0,235 | 2,35 |

| Post warranty | 0,19 | 0,26 | 2,6 |

The insurance premium is determined based on the size of insurance amount and tariff rates.

Franchise

Insurance contract specifies a franchise, which type and amount are determined by agreement between the Parties and set either a percentage of the insurance amount, or in absolute terms.