Property insurance

Air transport insurance

Object of insurance

The insurance hereunder shall cover the property interests of an Insured, related to possession, use, disposal of air transport (the “transport”), due to damage, loss, non-return or destruction (hijacking, theft) of the transport as a result of an insurance event stipulated in Insurance Agreement.

The following items shall be accepted for insurance:

- aircrafts (of civil, governmental and experimental aviation) that have a certificate of state registration of aircraft, certificate of airworthiness of aircraft or other replacing documents;

- individual parts of an aircraft installed on board of an aircraft and that have duly issued documents (passport, form etc.).

Insurance subject matter

The insurance shall cover air transport owned by an Insured on the right of possession, use, disposal. Insurance agreement may provide for insurance of two or more aircrafts.

Insurance event

Insurance event is damage, destruction (wreck) or loss/missing of air transport as a result of events specified in these Rules and stipulated by Insurance Agreement, namely:

- an aviation accident or an incident occurring from the moment when engine is started for a flight at an airport of departure until the moment when engine is turned off at an airport of destination (transit airport);

- a natural disaster occurring during aircraft parking;

- unlawful acts of the third parties that occurred while an aircraft is parked, namely as a result of theft, attack, robbery, destruction or damage of another person’s property intentionally or negligently.

For the purposes of these Rules, damage to an aircraft shall mean a breach of structural integrity or destruction of its units (parts) as a result of events specified in Insurance Agreement, which required emergency repair.

Destruction (total loss) of an aircraft shall mean total destruction of an aircraft when:

- none of its units may be used in the future for their intended purpose;

- there is technical impossibility or economic inexpediency of restoring an aircraft (when expenses of its emergency repair exceed 90% of its value as of the date of insurance event occurrence) as well as impossibility of using an aircraft for its intended purpose.

Loss/missing of an aircraft shall mean:

- loss of an aircraft when it has not arrived at its destination point after a scheduled departure during the period of validity of Insurance Agreement and its search activities within 60 (Sixty) days did not yield any results, or its search activities were officially terminated earlier than this period;

- loss of an aircraft due to forced landing in an area that is difficult to access and unsuitable for evacuation of an aircraft;

- loss of an aircraft as a result of theft, attack or robbery of an aircraft.

Natural disasters, as applied to these Rules, shall include the following:

1) earthquake, exposure to underground fire;

- mudflow, landslide, subsidence, rockfall, rock slide;

- storm, whirlwind, hurricane, tornado and other movement of air masses caused by natural processes in the atmosphere;

- flood, inundation, tsunami;

- groundwater action unusual for the area;

- hail or downpour if it is of a particularly dangerous nature and unusual for the area;

other natural disasters stipulated in Insurance Agreement.

Insurance amount и insurance premium

Insurance amount shall be determined in Insurance Agreement by mutual consent of the Parties, but may not be higher than the actual value of air transport at the moment of conclusion of Insurance Agreement. In case of insurance of additional risks, the insurance amount shall be determined by mutual consent of the Parties and shall be specified in Insurance Agreement separately for each risk.

In case of full value insurance, an aircraft shall be accepted for insurance:

- based on the book value (including depreciation) according to accounting records of a company;

- at the purchase price including overhead costs;

- at the price of average market value of an aircraft at the moment of conclusion of Insurance Agreement.

Amount of insurance premium payable under Insurance Agreement shall be calculated according to insurance tariffs determining the insurance premium rate charged from insurance amount taking into account the insurance facility and nature of insurance risk.

CLASSES OF AIRCRAFTS

- Class I airplane – 75 ton or more;

- Class II airplane – 30-75 ton;

- Class III airplane – 10-30 ton;

- Class IV airplane – up to 10 ton.

CATEGORIES OF AIRCRAFTS

- I category – aircrafts of classes 1-3;

- II category – aircraft of class 4;

- III category – helicopters.

Table of basic tariff rates for air transport insurance

No. | Risks | Percentage ratio | Basic tariff rate |

1 | Aviation accident, incident or any classified event | 40.00% | 0,9642 |

2 | Fire, natural disaster | 30.00% | 0,7231 |

3 | Unlawful actions of the third parties | 30.00% | 0,7231 |

| Total package | 100.0% | 2,4105 |

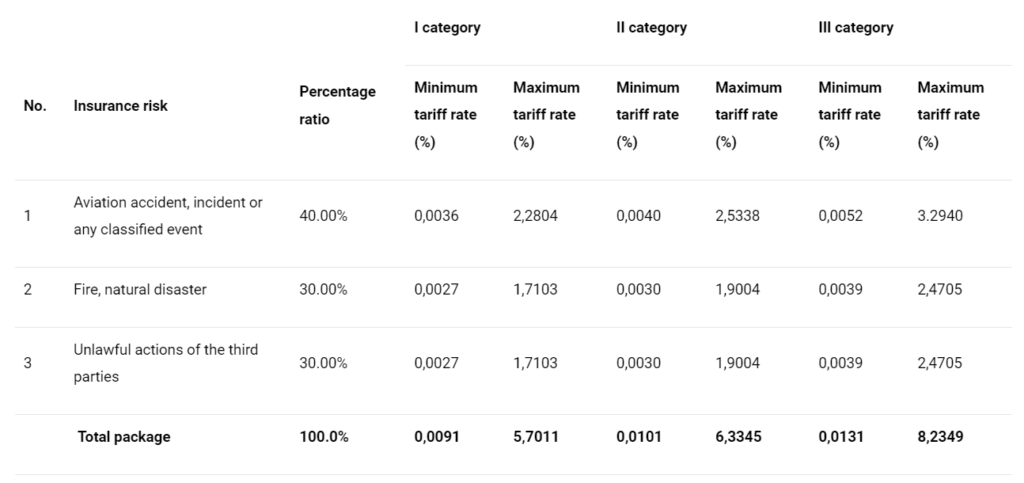

Table of minimum and maximum tariff rates for air transport insurance

No. |

Insurance risk |

Percentage ratio | I category | II category | III category | |||

Minimum tariff rate (%) | Maximum tariff rate (%) | Minimum tariff rate (%) | Maximum tariff rate (%) | Minimum tariff rate (%) | Maximum tariff rate (%) | |||

1 | Aviation accident, incident or any classified event | 40.00% | 0,0036 | 2,2804 | 0,0040 | 2,5338 | 0,0052 | 3.2940 |

2 | Fire, natural disaster | 30.00% | 0,0027 | 1,7103 | 0,0030 | 1,9004 | 0,0039 | 2,4705 |

3 | Unlawful actions of the third parties | 30.00% | 0,0027 | 1,7103 | 0,0030 | 1,9004 | 0,0039 | 2,4705 |

Total package | 100.0% | 0,0091 | 5,7011 | 0,0101 | 6,3345 | 0,0131 | 8,2349 | |